Are you a fan of those sealed 1 oz. silver JM bars? Do you fancy the shine of that sealed Sunshine Mint insignia? Well, consider breaking out the trusty scissors and acid test…

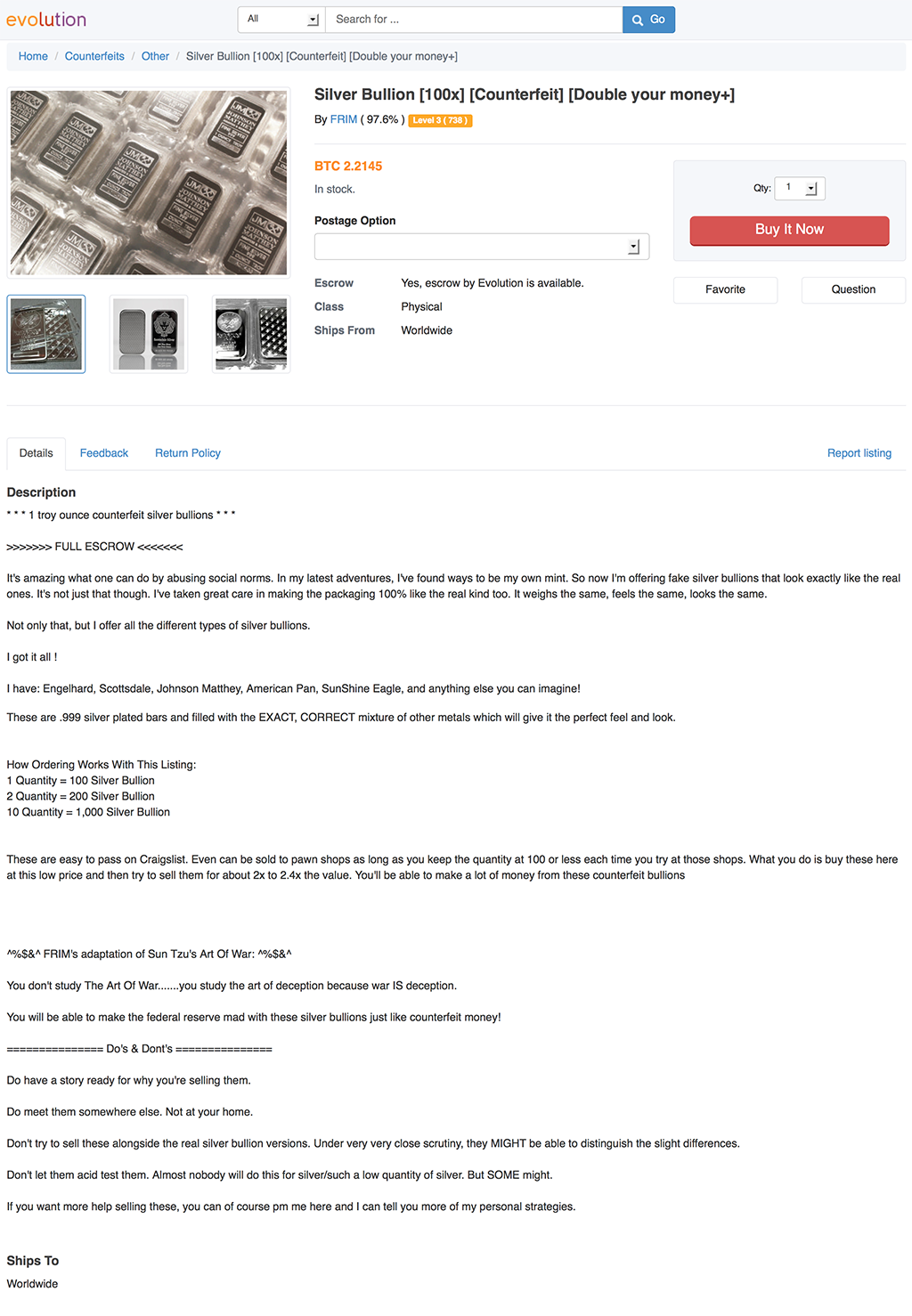

I received a tip from one of our readers that there is proliferation of fake silver and gold bullion on the so-called “darknet” markets. If you aren’t aware, the “darknet markets” are websites online where you can buy goods — mostly contraband or illegal — in exchange for the digital currency Bitcoin.

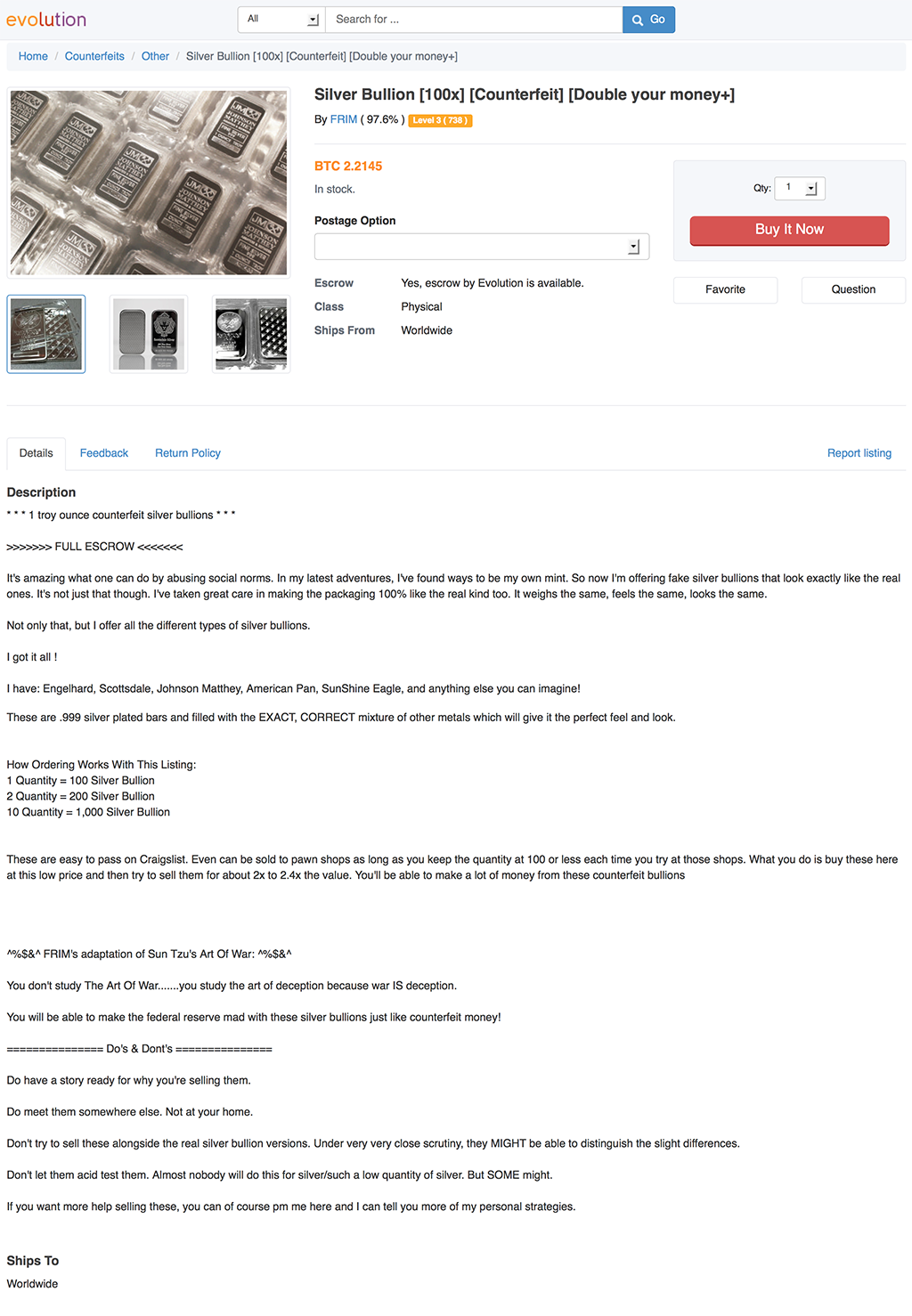

It seems there are a number of sellers offering passable counterfeits … Engelhard, Johnson Matthey, American Pan, Sunshine Mint… “and anything else you can imagine!”

Fake bullion isn’t new. But it’s getting cheaper and increasingly passable. A cursory search of the recently IPO’d Alibaba.com for “1 oz silver bar” yielded a number of results, which also seems to indicate that the market’s sellers are most likely resellers if the Eastern eCommerce giant:

http://www.alibaba.com/product-detail/Hot-sales-replica-1-Troy-Oz_1926671052.html

http://www.alibaba.com/product-detail/2014-high-quality-custom-made-silver_1964115283.html

http://www.alibaba.com/product-detail/1-oz-APMEX-Silver-Bar_801243543.html

http://www.alibaba.com/product-detail/Hot-sales-replica-1-Troy-Oz_1926690528.html

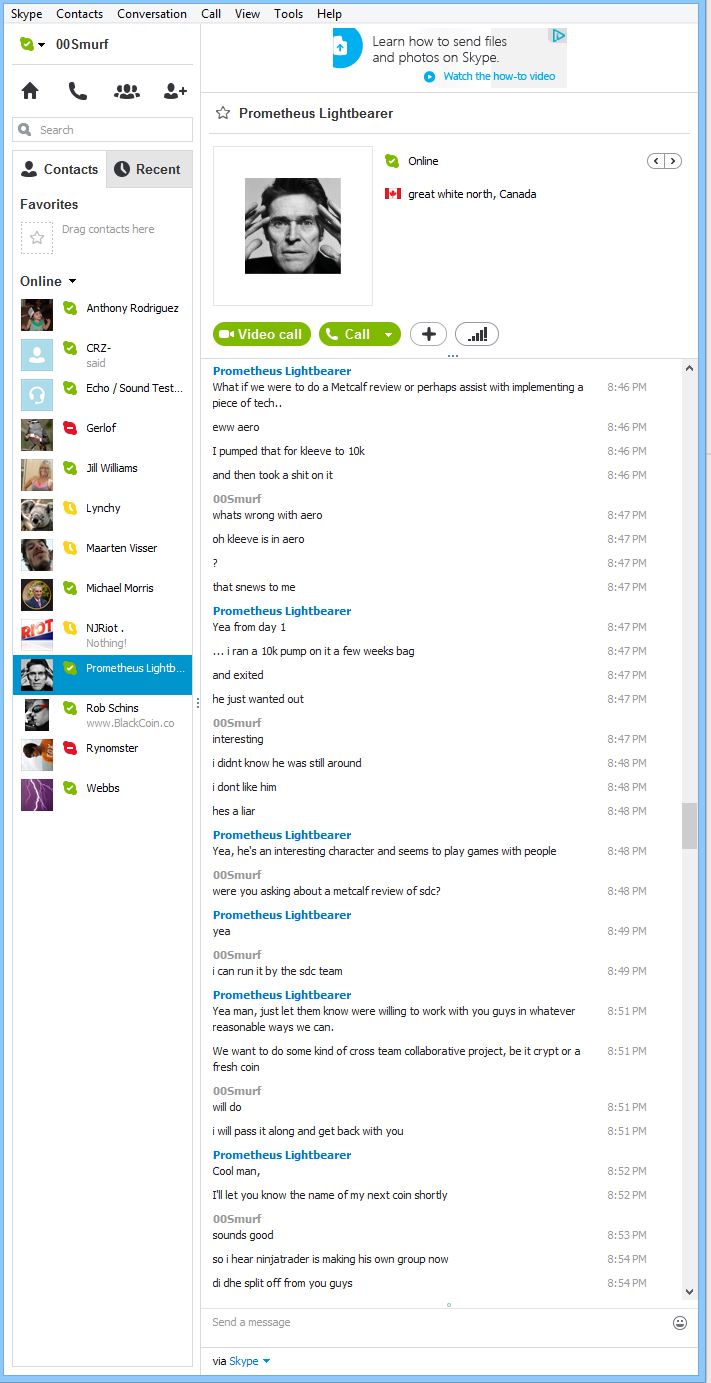

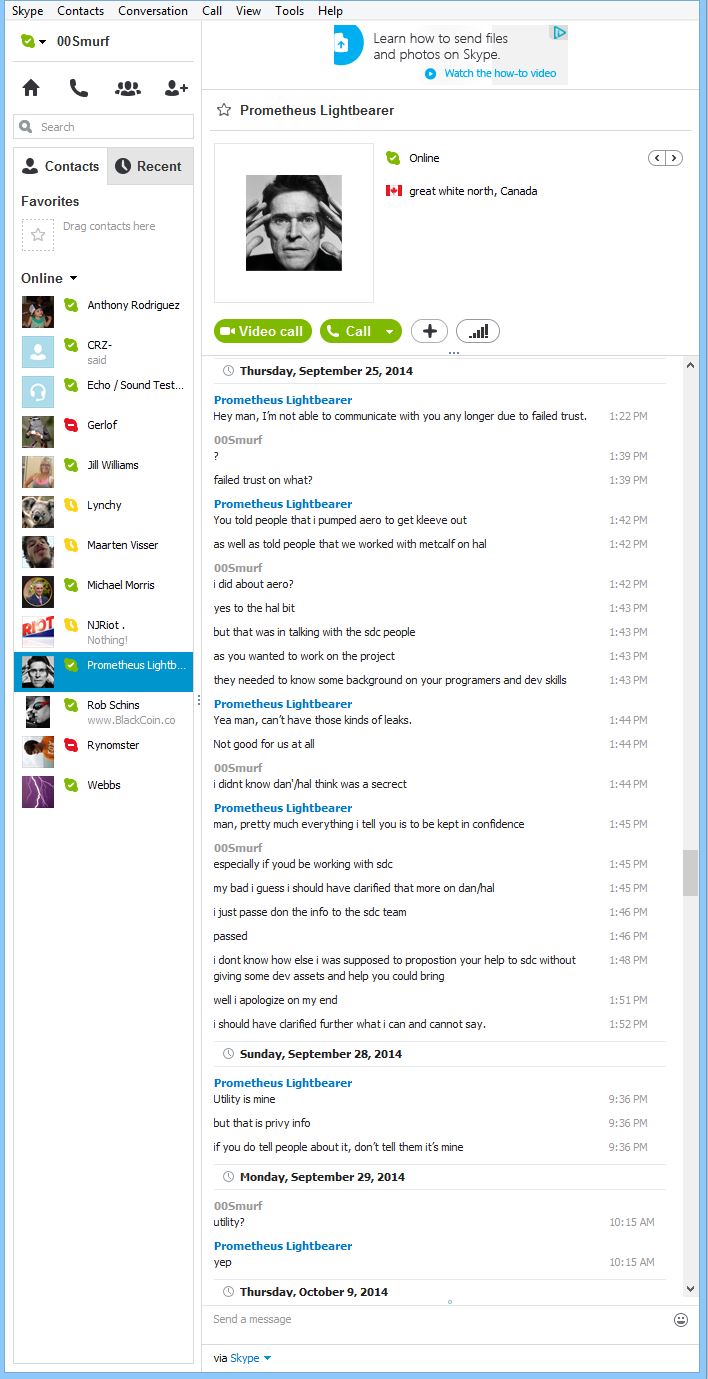

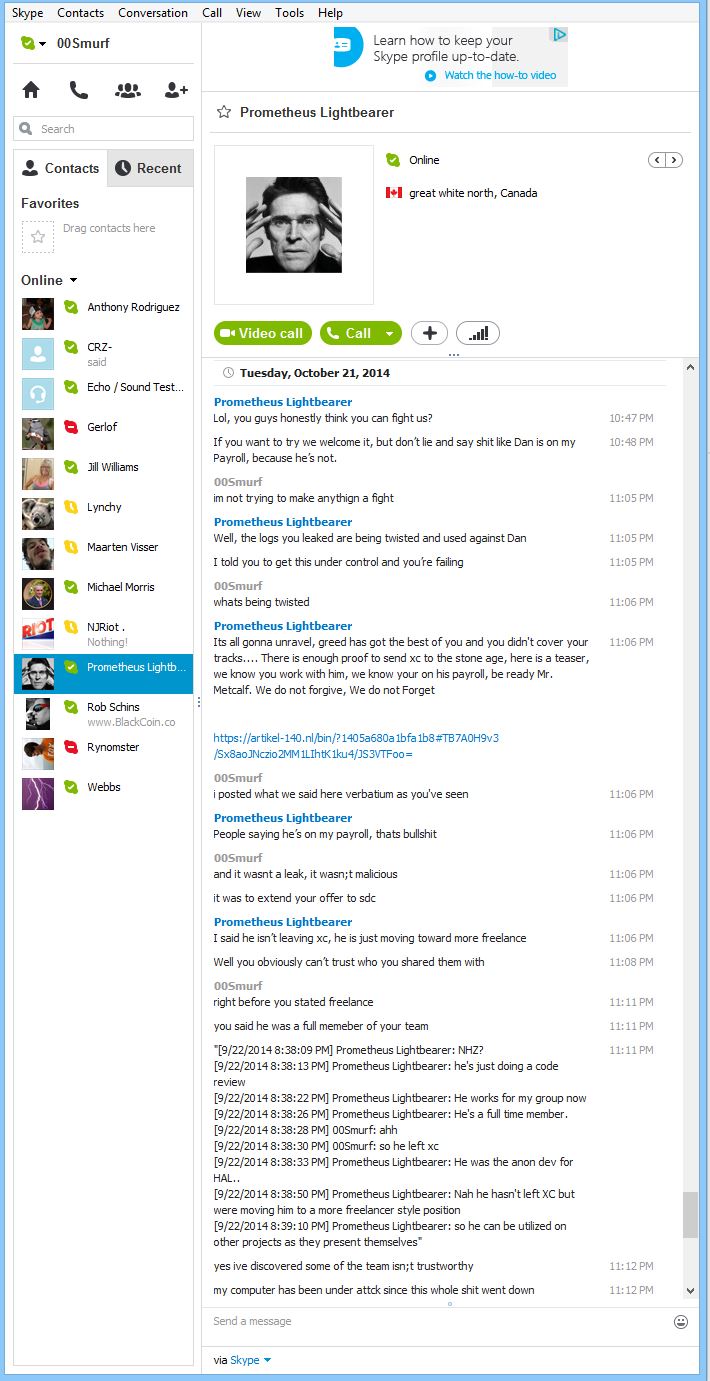

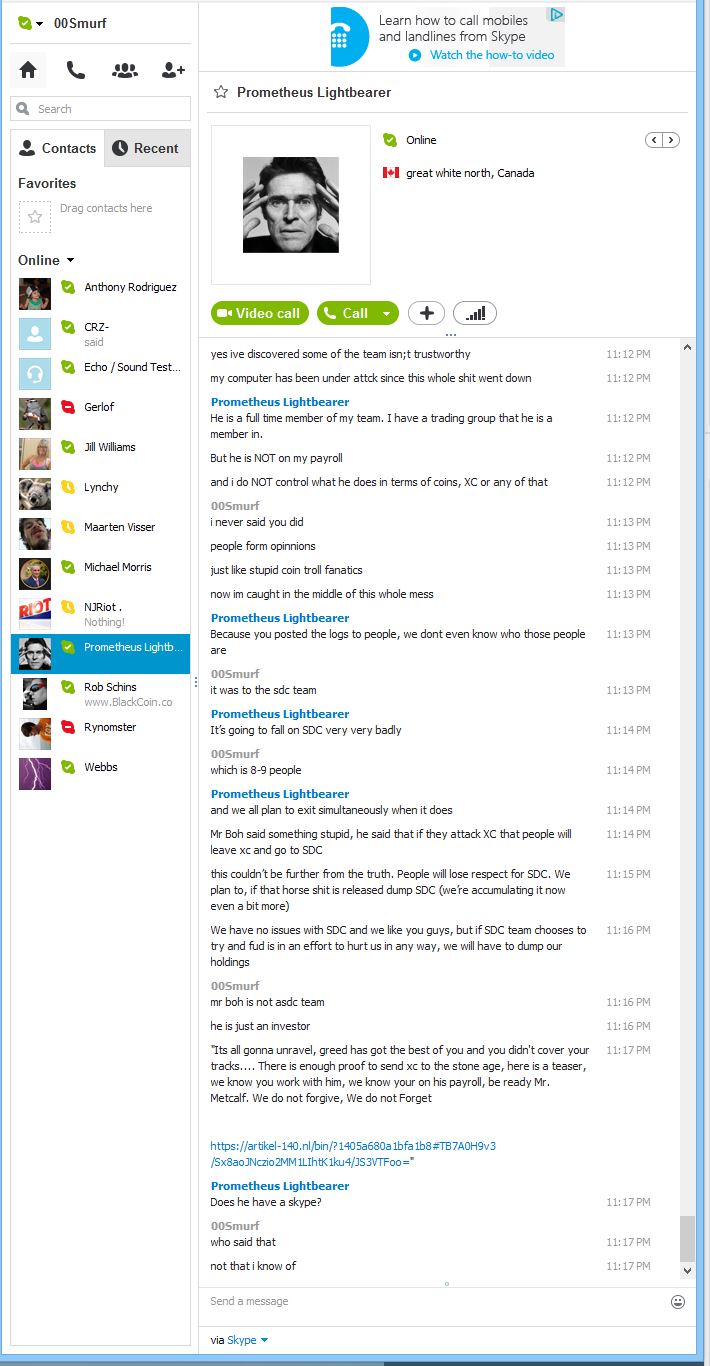

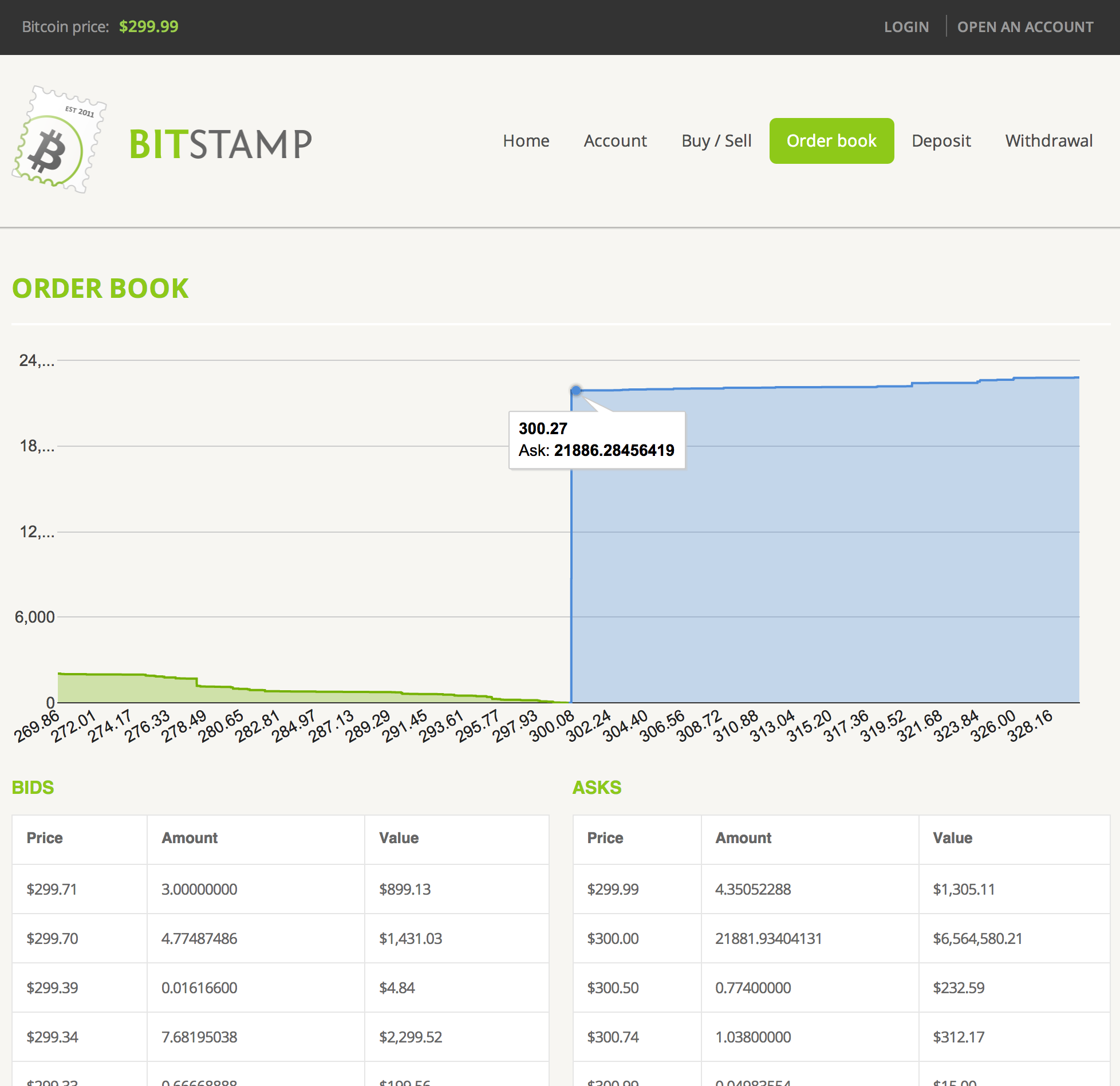

One seller (ad pictured below) even proclaims that these “.999 silver plated bars [are] filled with the EXACT, CORRECT mixture of other metals which will give it the perfect look and feel.” In the ad pictured, one can purchase 100 (1) ounce bars for 2.2145 Bitcoin, which equates to about $800 at today’s prices.

It’s clear that criminals are taking advantage of most stackers / dealers inability to test and verify the contents of every bar. The sheister even warns customers “Don’t let [dealers/pawn shops/craigslist consumers] acid test them. Almost nobody will do this for silver/such a low quantity of silver. But SOME might.”

What can stackers and the community do to protect themselves? Don’t buy from non-trusted sources (avoid Craigslist… the saying about ‘if the deal is too good to be true…’ prevails when dealing with metal). Keep a bottle of acid handy, and try to purchase at least one of each iteration of bar directly from the source or APMEX, so you have a point of comparison.

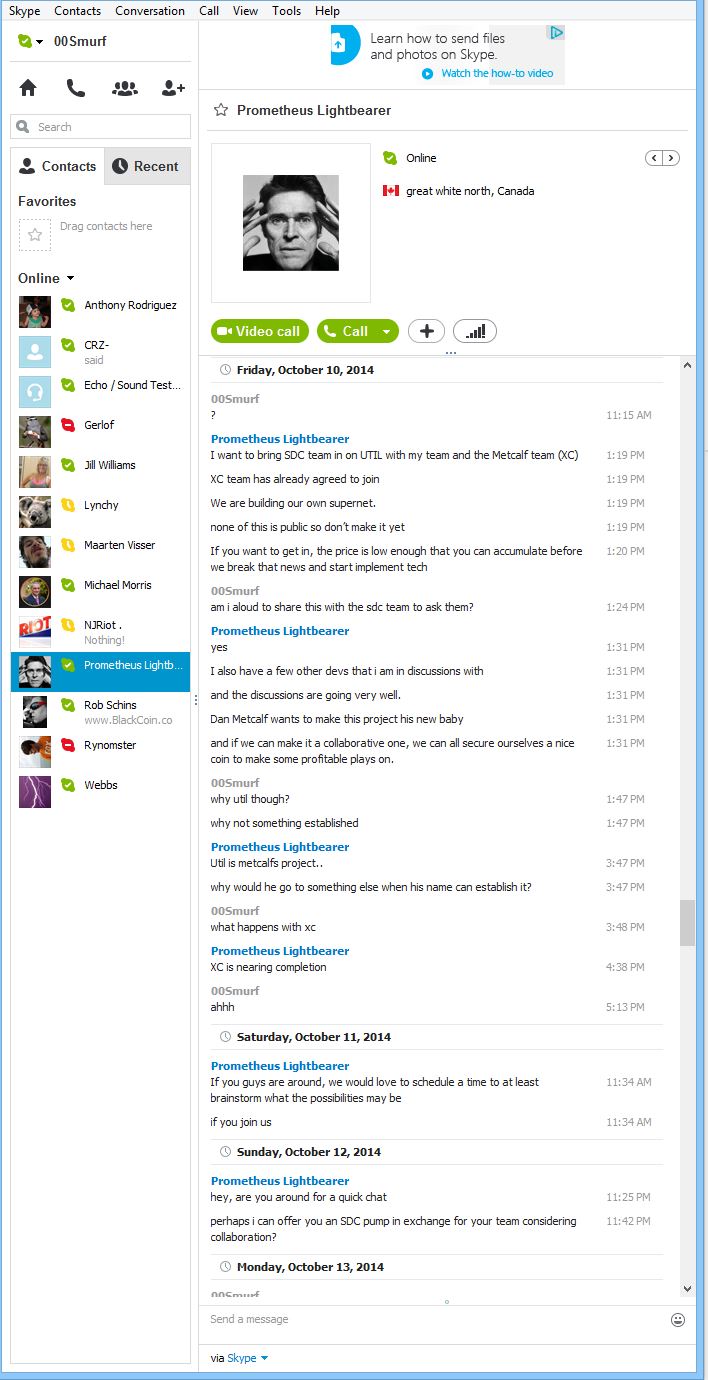

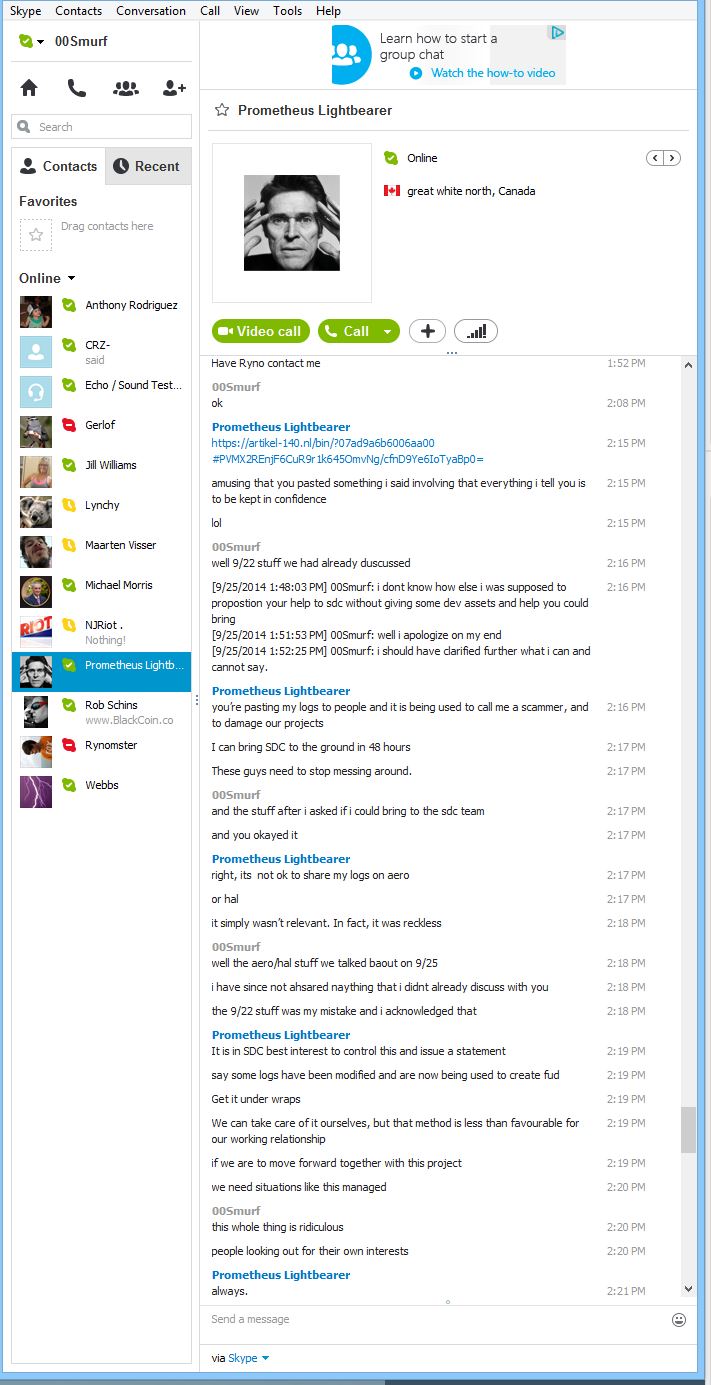

The counterfeit ad includes these photos, try to internalize the details.

It’s clear this problem will only get worse as prices for metal rise and the potential return on a counterfeit sale increases. It’s often better to pay premium to get one of the government minted coins, for instance the American Silver Eagle or Canadian Maple Leaf, which are far more complicated and easier to spot fakes.

Stay frosty out there and report any fakes you find to the appropriate mint.

| 1LWJs1RjasodgPuKjUWqMXszdkdt9y6DsP

| 1LWJs1RjasodgPuKjUWqMXszdkdt9y6DsP  1LWJs1RjasodgPuKjUWqMXszdkdt9y6DsP

1LWJs1RjasodgPuKjUWqMXszdkdt9y6DsP